The outflow of talented Britons to the United Arab Emirates will reach record levels in 2025. According to the Henley Private Wealth Migration Report, around 16,500 wealthy Britons will leave the United Kingdom, while the UAE will attract almost 9,800 new millionaires, more than any other country worldwide. It is not only the super rich. A recent survey shows that 28 percent of young Britons are seriously considering emigrating or are already planning to do so.

If you are among the Britons who have had enough of rising taxes, unaffordable house prices and political stagnation, this guide offers a structured roadmap for your fresh start in Dubai or Abu Dhabi.

Why Britons are leaving the United Kingdom and what the UAE offers

The reality in the United Kingdom in 2025

The reasons for British emigration are varied yet clearly visible.

Crushing tax burden: Frozen tax thresholds, higher dividend and capital gains taxes, and the planned abolition of non-dom status are weighing on earners and investors alike. Even average earners are drifting into higher tax bands.

Unaffordable housing: Even with six-figure annual salaries, many Britons cannot afford a home. In London, an average apartment costs 15 times the median annual income.

Economic stagnation: GDP growth has been stagnant for years, public services are overstretched and infrastructure projects are chronically delayed.

Societal challenges: Knife crime, unrest and a divided justice system make many Britons reluctant to walk home alone at night. An entire generation that did everything right still finds itself without a home of its own.

What the UAE does differently

0 percent income tax: Your local salary in the UAE is not taxed, although tax obligations in your home country may still apply.

Golden Visa pathways: Long-term residence permits of 5 to 10 years through real estate or business investments.

Booming economy: Real growth opportunities rather than only skyscrapers, with a dynamic market for entrepreneurs and skilled professionals.

Exceptional safety: Dubai and Abu Dhabi rank among the five safest cities in the world.

First-class quality of life: 365 days of sunshine, world-class international schools, top-tier private healthcare and a truly global expat community.

Dubai or Abu Dhabi: Which lifestyle suits you?

Dubai – The international hub

Dubai is fast-paced, entrepreneurial and highly international. The city is ideal for:

- Young professionals who want a vibrant social life.

- Digital nomads and freelancers who value networking and co-working spaces.

- Entrepreneurs and investors who want to leverage a dynamic regional hub.

Premium residential areas for different lifestyles:

- Downtown Dubai, Dubai Marina, Business Bay: High-rise city living with skyline views.

- Palm Jumeirah, Emirates Hills: Luxurious, exclusive gated communities.

- Arabian Ranches, Dubai Hills Estate, JVC: Family villas and community living.

Abu Dhabi – Calm and stability

Abu Dhabi is calmer, more family-oriented and government-centric, with strong sectors in energy, finance and public institutions. The city suits:

- Families who prefer a somewhat quieter, more traditional atmosphere.

- Senior executives in large organizations.

- Long-term investors who seek a more stable market.

Key freehold zones:

- Yas Island: Theme parks, marinas and family-friendly living.

- Saadiyat Island: Beachfront properties and the cultural district.

- Al Reem Island: High-rise urban living near the city center.

First choose your preferred lifestyle, then narrow down two to three neighborhoods that match your budget and family needs.

Use your visa options strategically

Golden Visa through real estate (most popular option)

Minimum investment: AED 2 million (approximately GBP 435,000) in real estate.

Structure: One or multiple properties, as long as the total value is met.

Financed properties: Allowed if your equity meets the minimum investment.

Term: 10-year Golden Visa with eligibility to sponsor family members.

This route is ideal if you want to build a long-term base in the UAE, diversify away from UK real estate and secure a transparent, asset-based path to residency.

Work visa

If you have a concrete job offer in Dubai or Abu Dhabi, the work visa is often the simplest route:

- Your employer sponsors your residence permit.

- Most formalities are handled by the company.

- You can later purchase a property and upgrade to a Golden Visa.

Golden Visa through business investment

Available to entrepreneurs and investors through:

- Establishing a UAE company with a minimum investment of AED 2 million.

- Acquiring equity in existing UAE companies.

- Investing in regulated UAE investment funds.

This route is suitable if you are building a business in the region, prefer operational assets or want to be physically present in the UAE.

Talent and specialist route

Long-term residence permits are also available for:

- Doctors, scientists and medical specialists.

- Highly skilled IT, engineering and tech professionals.

- Senior executives with high salaries and recognized qualifications.

Additional options

- Remote Work Visa: For employees who work online for an overseas employer.

- Freelancer visa: Available in certain free zones.

- Retirement visa: For those over 55 with sufficient assets.

Since regulations can change, always check current government policies or speak with licensed advisors.

Clean tax departure from the United Kingdom

Moving to a country with 0 percent income tax is attractive, but you must leave the United Kingdom correctly for tax purposes.

Understand the Statutory Residence Test

Learn how many days you can spend in the UK after moving without becoming tax resident again. Connections such as property, work and family count alongside the number of days.

Use the correct forms

You will usually complete form P85 to inform HMRC of your departure and to clarify your tax status for the year you leave.

Make sales and asset decisions

Consider which UK assets to sell before departure, which properties to rent out and what this means for income tax and capital gains tax.

Seek professional advice

A short consultation with a qualified UK tax advisor who understands expat and non-resident rules can save you significant money and stress.

Secure your income base

Your move will only be stable if your income base in the UAE is solid.

As an employee

- Clarify your total package including housing allowance and school fee support.

- Understand probation terms and notice periods.

- Check whether your employer provides relocation support or family flights.

As an entrepreneur

Free zone company:

- 100 percent foreign ownership is possible.

- Often faster and simpler setup.

- Ideal for consulting, digital business and B2B activities.

Mainland company:

- Required for direct trade across the UAE market.

- Often preferred for physical businesses and certain services.

Align your structure with your visa route, client base and lifestyle.

Lion & Land works with reputable company formation providers in Dubai and Abu Dhabi and helps you compare options transparently.

Putting the move into practice

Housing

Rent in the first year to get to know different areas. Expect rent to be paid in 1 to 4 cheques plus a security deposit. Only buy in a freehold area once you are confident you will stay.

Banking

Open a UAE bank account as soon as you have your Emirates ID. Keep at least one UK account for ongoing commitments.

Healthcare

Health insurance is mandatory in both Dubai and Abu Dhabi. Standards are high with many English-speaking doctors.

Schooling

If you have children, apply early to British or IB schools. Demand is strong in popular schools and year groups.

Real estate as an investment: Strategic wealth building

Beyond relocation planning, real estate investments in the UAE offer unique opportunities for strategic wealth creation. Dubai recorded over 120,000 real estate transactions in 2024 with a total value exceeding AED 500 billion.

Understand the return potential

Average gross yields: 6 to 8 percent in established areas.

Off-plan projects: Often higher ROI due to entry at lower prices.

Luxury segment: Palm Jumeirah and Downtown achieve premium yields.

Growth areas: Dubai South and Dubai Hills show strong appreciation potential.

Investment hotspots for British buyers

Dubai Marina: Strong expat demand and consistent rental yields.

Business Bay: Commercial development with waterfront projects.

JVC (Jumeirah Village Circle): Family-friendly, affordable and high rental yields.

Downtown Dubai: A prestige address near Burj Khalifa.

Real Estate Investment Calculator: Realistic calculations

To make informed investment decisions, you should include all factors in your ROI calculation.

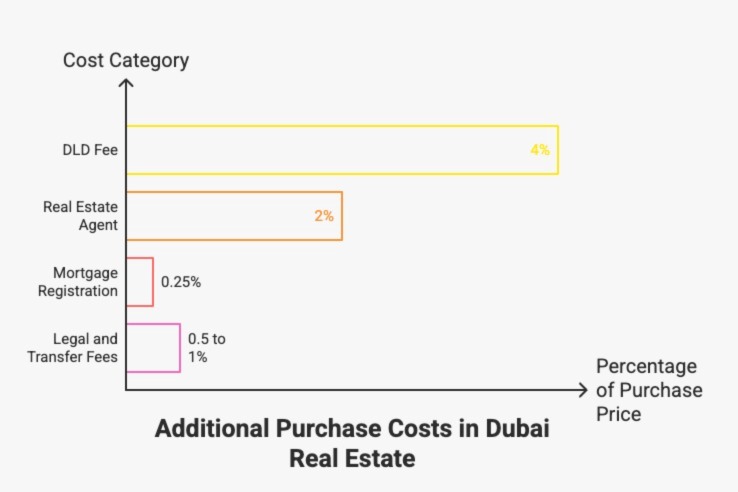

Purchase costs (approximately 7 to 10 percent of the purchase price)

- Dubai Land Department (DLD) fee: 4 percent of the purchase price.

- Real estate agent: 2 percent, usually paid by the seller.

- Mortgage registration: 0.25 percent if financed.

- Legal and transfer: 0.5 to 1 percent.

Ongoing costs (annually)

- Service charge: AED 10 to 25 per square foot depending on the building.

- Home contents insurance: 0.1 to 0.2 percent of the property value.

- DEWA (electricity and water): AED 300 to 800 per month per unit.

- Internet and TV: AED 300 to 500 per month.

Example calculation: 1-bedroom in Dubai Marina

Purchase price: AED 1.2 million (approximately GBP 261,000).

Annual rent: AED 85,000 (approximately GBP 18,500).

Gross yield: 7.1 percent.

Ongoing costs: AED 15,000 per year.

Net yield: 5.8 percent.

These calculations help set realistic expectations and compare different properties objectively.

How Lion & Land supports you

At Lion & Land, we position ourselves as your strategic partner for relocation and investment in Dubai and Abu Dhabi.

Specifically, this means:

- We match your lifestyle, budget and risk appetite to specific neighborhoods and Golden Visa-eligible properties.

- We help you understand how real estate decisions connect to residency options.

- We coordinate with licensed company formation providers for entrepreneurial visa routes.

- We connect you with vetted UK and UAE tax, legal and immigration specialists.

- We accompany you from the first consultation to your Emirates ID and your first set of keys.

You remain in control of every decision. We make the path clearer, safer and more efficient.

Conclusion: The right time for a fresh start

Leaving the UK for the UAE is no longer a luxury phenomenon in 2025. It is a strategic decision for many Britons who want to improve their quality of life, financial freedom and career prospects. With 0 percent income tax, stable visa programs and a booming economy, the UAE offers an attractive alternative to the British status quo.

The key lies in structured planning. Choose the lifestyle that suits you, secure your visa and income source, leave the UK correctly for tax purposes and use real estate investments as a strategic wealth builder.

With the right preparation, your big leap will become your new normal within a few months in one of the safest and most dynamic regions in the world.

Are you ready to move from dreaming to concrete planning? Book a non-binding consultation with Lion & Land and let us design your personal path from the UK to the UAE.

Disclaimer: This article is for general information only and does not constitute legal, tax, immigration or investment advice. Lion & Land is not a law firm, tax practice or regulated immigration advisory. Visa rules, tax laws and real estate regulations change, and their application depends on your personal circumstances. Before making decisions, always verify details with qualified professionals in the UK and the UAE.

Frequently Asked Questions (FAQ)

Can Britons buy property without UAE residency?

Yes, foreigners can purchase property in designated freehold areas of Dubai and Abu Dhabi without already being residents. The property purchase can then serve as a basis for a Golden Visa.

How long does a Golden Visa application through real estate take?

After purchasing property and submitting all documents, Golden Visa approval typically takes 2 to 4 weeks. The Emirates ID is usually issued 2 to 3 weeks later.

What is the minimum investment required for a 5-year visa?

For a 5-year investor visa, you need a minimum real estate investment of AED 2 million. For shorter visa options of 2 years, the threshold is AED 750,000.

Is financing available for non-residents?

Yes, UAE banks typically offer up to 60 percent financing to non-residents and up to 80 percent for residents. Proof of income and solid creditworthiness are required.

What are the annual running costs in Dubai?

For a 1-bedroom apartment, you should budget AED 15,000 to 25,000 annually for service charges, insurance and utilities. Luxury properties with extensive amenities can have higher costs.

Can property income be transferred to the UK?

Yes, rental income can be freely transferred. However, consider potential UK tax liabilities on foreign income and currency risks during the transfer.